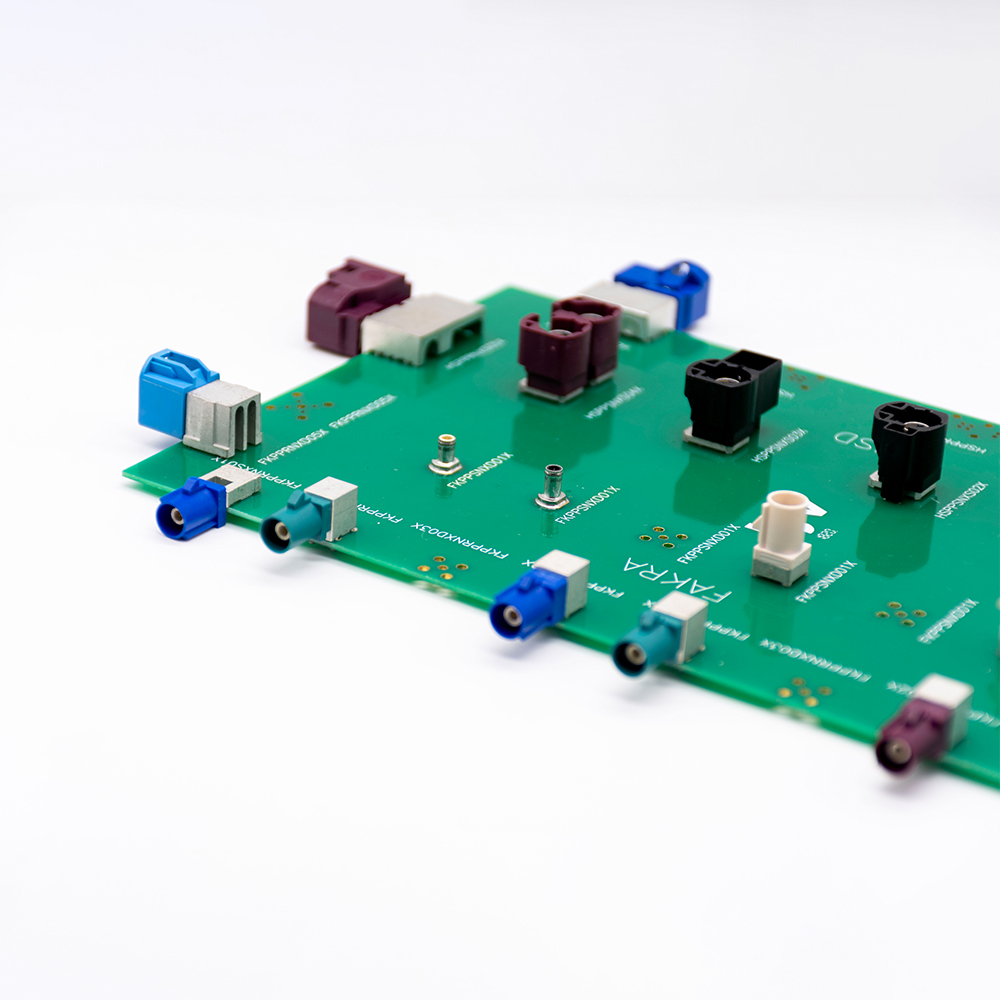

With the current development of new energy vehicles in the direction of intelligence, intelligent driving systems continue to be superimposed to the L3 level. The number of sensors (cameras, millimeter-wave radar, LIDAR, etc.) continues to increase. Today, our new energy automotive high-speed connector supply chain topics include four main categories: FAKRA connectors, Mini-FAKRA (HFM) connectors, HSD connectors, and Automotive Ethernet connectors.

The demand for functions such as parking assistance, lane departure warning, night vision assistance, adaptive cruise control, anti-collision, blind-spot detection, and driver fatigue detection is increasing. This has led to ADAS (Advanced Driver Assistance Systems) being equipped with higher bandwidth transmission networks. The main purpose of automotive connectors is to enable connectivity, in case of circuit differences or circuit isolation. And this is necessary for moving vehicles.

High-speed Connectors: Meeting the demand for automotive intelligence

FAKRA is a high-speed connector that is currently used more often in conventional passenger vehicles. FAKRA is generally used for sensor installation connections. Mini-FAKRA is used as a transmission intermediary between sensor data and the AVM system due to its good integration performance. HSD is mainly used for high-speed transmission from AVM to the host side and host side to the cabin side. Ethernet is used as the backbone network for in-vehicle communication, connects various subsystems inside the vehicle end.

FAKRA, on the other hand, has a low data transfer volume, a large structural component size. And is incompatible with the current mainstream architecture interface protocol. The HFM is currently being developed to meet all of the needs of sensors such as cameras and radars for ADAS, high-resolution displays for infotainment systems, and V2X antennas for vehicle networking while achieving an 80 percent size reduction and a significant increase in data transmission.

With the accelerated speed of the process of vehicle networking, the usage of single-vehicle high-speed connectors has increased substantially. And it is expected that there may be a wave of replacement of traditional FAKRA by Mini – FAKRA in the next few years.

And HSD is used in combination with HFM. Such as the camera will collect data through the HFM to the vehicle surround-view system.And then the HSD will transmit the data to the host. Therefore, the vehicle only to achieve a variety of intelligent needs. You need to use multiple connected devices, including waterproof FAKRA, HFM, and HSD.

Market Space Measurement: High-speed connectors

We estimate the domestic market size based on the current status of the automotive high-speed connector market as follows.

The current application scenario of in-vehicle Ethernet mainly lies in the ADAS domain, IVI infotainment domain (display, front-mounted navigation system), and Netlink system (T-Box, high-speed gateway, etc.). So we only consider the usage of high-speed, high-frequency connectors in these three parts in our measurement model.

Given that in links related to ADAS, IVI systems and Netlink, there are still certain low-speed connector usage scenarios. Therefore, we assume that the penetration rate of high speed and high-frequency solutions in ADAS, IVI systems, and Netlink will increase from 70% in 2020 to 80% in 2025. And we default to fully high-speed connectors in the connection between domain controller boards and Ethernet diagnostic ports.

The unit price of high-speed and high-frequency connectors in 2020 is about 25 yuan. Looking backward, in order to achieve more intelligent cockpit interaction, higher level of autonomous driving, and lower latency intelligent network connection.

The demand for high-speed, high-frequency connector transmission rate will gradually rise from 150Mbps (vehicle condition report, general IVI system, and other functions) to 24Gbps (L3~L4 level ADAS, advanced IVI system, and other functions). Therefore, we assume that the unit price of high-speed, high-frequency connectors will maintain an annual growth of 10% in 2021-22 and 5% in 2023-25.

We estimate that by 2025, China’s automotive high-speed, high-frequency connector market size will be up to about 23 billion yuan. Corresponding to 2021-25 CAGR of about 54%.

High-speed Connector Market Barriers

The current high-speed connector market is mainly in the hands of Europe, the United States, Japan, and other countries. International manufacturers to enter the connector market earlier in the connector has rich technical reserves. The connector products in the underlying principle of commonality, so manufacturers in other areas of development experience can be referred to and used in the automotive connector field.

Due to its early entry into the industry, the technology has accumulated a wealth of experience and established a stable customer relationship with various industries. Therefore, the automotive high-speed connector industry entry barrier is high, mainly in the following areas.

Technical Barriers

High-speed connectors have a wealth of technical accumulation is an inherent advantage. And this is reflected in the rapid development of the mold, production, and other capabilities, and its leading level of technology, a wealth of experience in testing will directly affect the stability of product quality and supply speed, which ultimately affects the cost of the product. High-speed response to downstream customer demand has also become one of the necessary conditions for miniature electrical connector companies.

Financial Barriers

Connector single value amount is not high, but the development of the connector involves R & D, mold design and development, manufacturing, and other aspects of the equipment is more expensive, and some of the equipment unit price of more than one million. Therefore, you must have a production scale and strong investment capital to have a significant advantage. Therefore, this industry also has a high industry barrier.

Long Validation Period and Strict Standards

Passenger vehicles are durable goods, so they have stricter requirements on the quality and stability of parts. The life cycle of a vehicle manufacturer’s power platform is generally 5-7 years. Vehicle manufacturers have established a relatively complete quality assessment and certification system internally. The entire process generally takes 1-2 years from product certification to mass supply.

Summarize

Intelligent car development has become a market trend. The generation of massive amounts of data will certainly breed more industrial applications. Benefit from the new energy trends in the automobile, domestic automotive connectors ushered in the “bend to overtake” opportunities. Domestic new energy vehicles are developing rapidly, and local connector manufacturers have successfully entered the new energy vehicle industry chain.

Before this, the traditional fuel car connector market was usually occupied by international manufacturers, with high barriers to entry. China is the core birthplace of the new energy vehicle market, domestic manufacturers have a geographical advantage. Coupled with the current window of high-voltage, high-speed connector product iterations, domestic manufacturers ushered in the incremental market space.

In addition, the domestic new energy vehicle-related components product standards certification is more stringent. Only products that meet the “Electric Vehicle Safety Technical Requirements” and other three mandatory national standards for automotive connectors are allowed to carry. Therefore, in terms of the time window for product introduction, local and international manufacturers are in the same position.

At the same time, the domestic manufacturers continued to invest in technology to usher in the harvest period. And in the high-voltage and high-speed connectors launched a mature product. Domestic manufacturers attach great importance to technology investment. In the last three years, R & D expenses have been higher than foreign manufacturers, and product development and upgrading will be strong.

After years of technical precipitation, the design capability and automation production capacity have reached the corresponding requirements. We can realize the mass production of high-end products and gradually break the monopoly of international industry giants on downstream OEM (Original Equipment Manufacturer) and provide diversified connector product series. Layout to meet market trends, looking for certainty of industry growth, will greatly reduce investment risk.